springfield mo sales tax on food

What Is Food Tax In Springfield Mo. There is no applicable special tax.

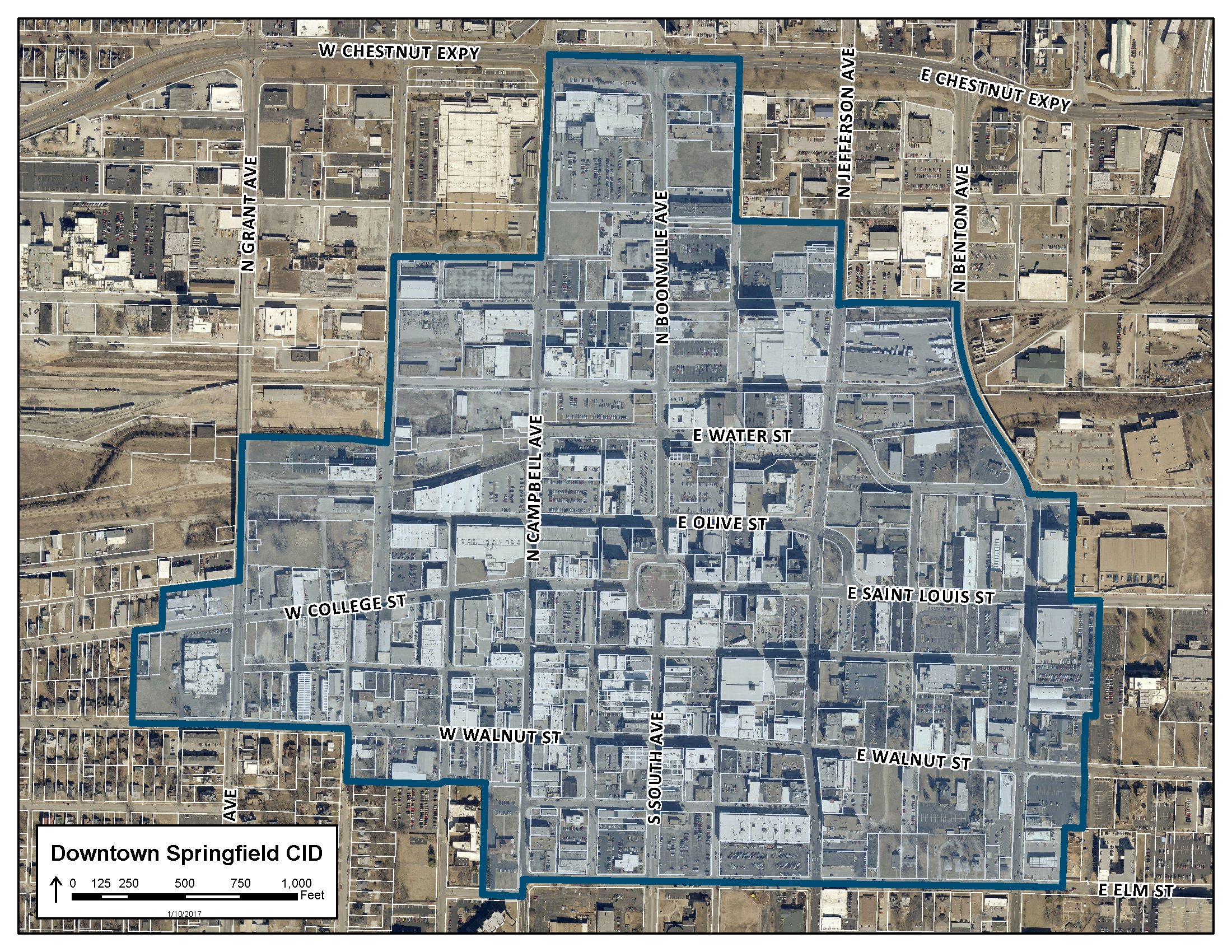

Downtown Springfield Community Improvement District

The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax.

. The SalesUse Tax Exemption Certificate must be given to the seller by the purchaser. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 782 in Springfield Missouri. Stanton MO Sales Tax Rate.

With local taxes the total sales tax rate is between 4225 and 10350. What is the sales tax rate in Springfield Missouri. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

No SB727 creates a sales and use tax exemption for farm products sold at farmers markets. Use tax is imposed on the storage use or consumption of tangible personal property in this state. The current total local.

The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales. Sales Tax Breakdown Springfield Details. Higher sales tax than 61 of Missouri localities 15 lower than the maximum sales tax in MO The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175.

Counties and cities can charge an additional local sales tax of up to 5125 for a. The current total local sales tax rate in Springfield MO is 8100. Created May 29 2008.

The county sales tax rate is. What is food tax in springfield mo. Missouri has recent rate changes Wed Jul 01 2020.

The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. The state sales tax rate in Missouri is 4225.

If your business activity involves operating a food establishment proof of a healthfood permit is required prior to issuing the license. This is the total of state county and city sales tax rates. The 4225 percent state sales and use tax is distributed into four funds to finance portions of.

All numbers are rounded in the normal fashion. The minimum combined 2022 sales tax rate for Springfield Missouri is. Review the sales tax benchmarks.

The December 2020 total local sales tax rate was also 8100. Create an Account - Increase your productivity customize your experience and engage in information you care about. Lawmakers exempted food sales from the 3 general revenue tax because the purpose at the time was to reduce state revenue below constitutional limits.

While the missouri statewide sales tax rate on food is reduced to 1225 local tax rates still apply. The 81 sales tax rate in Springfield consists of 4225. Missouri Retail Sales Tax License.

Woman Sentenced 3 Years Prison For 1 3 Million Theft And Tax Fraud Scheme While Employed By Springfield Mo Company Koam

Expert Advice For Moving To Springfield Mo 2022 Relocation Guide

Small Restaurant Business For Sale In Springfield Missouri Bizbuysell

Taxes Springfield Regional Economic Partnership

Is Food Taxable In Missouri Taxjar

/cloudfront-us-east-1.images.arcpublishing.com/gray/2THX3NIVLJFVXF4ELM4GSKGWVQ.jpg)

Missouri Bill Calls To End State Sales Tax On Food And Groceries

Illinois Sales Tax Calculator And Local Rates 2021 Wise

/cloudfront-us-east-1.images.arcpublishing.com/gray/HVYSS47KLZFNXCX7WWPTGQ52L4.jpg)

Missouri S Grocery Tax Could Be Going Away Soon

Springfield Missouri Wikipedia

April Friday Forum Empower Missouri

Downtown Springfield Community Improvement District

Businesses And Lawmakers Say Missouri Online Sales Tax Bill Could Help Level Playing Field

Businesses And Lawmakers Say Missouri Online Sales Tax Bill Could Help Level Playing Field

News Flash Springfield Mo Civicengage

/cloudfront-us-east-1.images.arcpublishing.com/gray/KWUPCXIAZJGU3E4TBJBR5DW5IQ.PNG)

Missouri Lawmakers Discuss Easing Tax On Groceries

Missouri Sales Tax Small Business Guide Truic

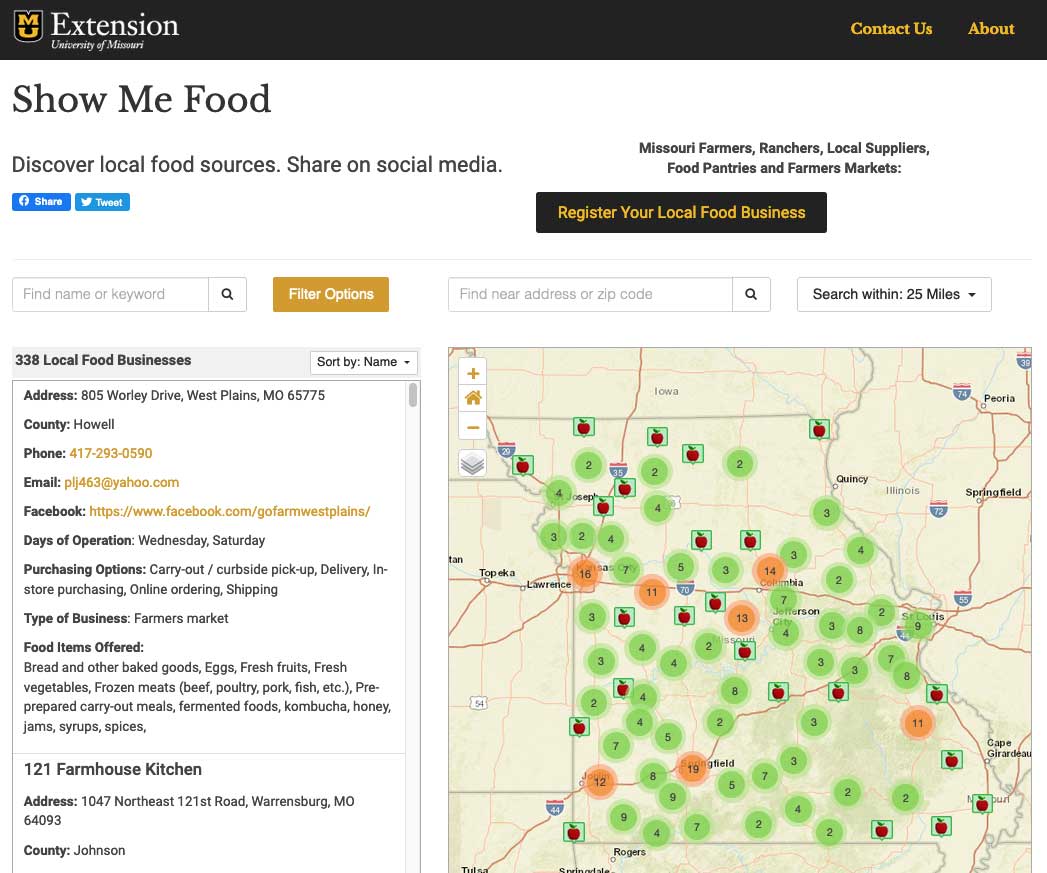

Missouri Food Finder Mu Extension

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com